Transportation

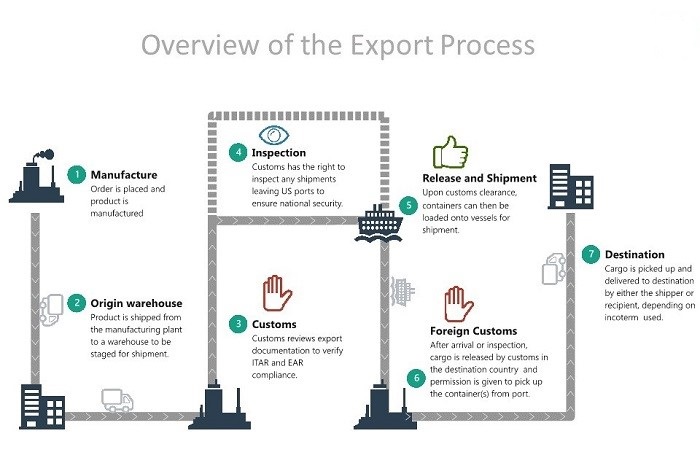

With the successful sale of your product into an international market, you now must be aware of the differences between shipping domestically and abroad. It is important to create a good checklist to make sure you have everything you need to get your product seamlessly out through US customs and into another country to your end buyer. This is a graphic that shows the basic steps for shipping your product to an export market, for each of these steps, we have broken out the things you need to consider.

What modes of transportation are available to move products?

Generally, there are four modes of transportation to move product from one country to another.

- Air

- Ocean

- Rail

- Truck

How do I determine my legal and logistical responsibilities for each leg of shipping my product?

For any shipping transaction, whether specified or considered to be common knowledge, someone is legally and logistically responsible for each piece of the process. Sometimes, this responsibility is not clearly set forth. For example, earlier this week, I picked up my phone and swiped to purchase a new cook book on Amazon. I now expect my cook book to arrive on my doorstep within three days and I also expect, if something should happen to it between now and that time, that Amazon will take full responsibility and I will still end up with my cookbook at the end.

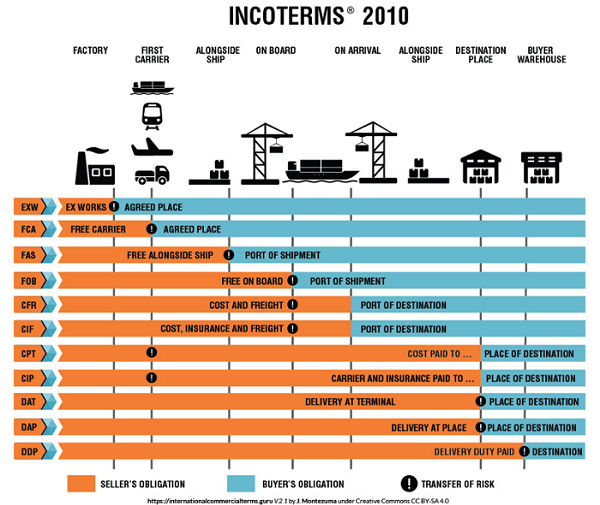

For commercial shipments, this type of expectation is explicitly stated with terms and agreed upon by both buyer and seller in advance via “Incoterms”. What are Incoterms you may ask? They are a pre-defined set of international rules published by the International Chamber of Commerce and used worldwide in commercial transactions. Here is a chart to introduce all of our terms:

What responsibilities do Incoterms delineate?

Incoterms DO tell the buyer and seller the following:

- They define the obligations between the buyer and seller for operations and costs.

- They define the point of passage of risk between buyer and seller in the case of something happening to the product

- They provide instructions to those handling the goods (i.e. the shipper, freight forwarder, customs brokers, and bankers)

Incoterms DO NOT:

- Have any effect on the passage of title for the goods.

- Provide for a mechanism of payment for the goods.

- Cover insurance (with the exception of the C terms) explicitly for the goods.

What do the different terms actually mean?

The following terms apply to any mode of transportation:

EXW – or ExWorks

FCA – or Free Carrier

CPT – or Carriage Paid To

CIP – or Carriage and Insurance Paid to

DAT – or Delivered at Terminal

DAP – or Delivered at Place

DDP – or Delivered Duty Paid

The following terms apply only to sea and inland waterway transport:

FAS – or Free Alongside Ship

FOB – or Free on Board

CFR – or Cost and Freight

CIF – or Cost, Insurance, and Freight

Step 1: Once the order is placed, then what?

Packing the Product for Export

The demands that international shipping puts on packaged goods can be very specific. Also, many potential problems, that must be thoughtfully reflected about beforehand, can arise during the shipment. Be sure your goods are prepared using these guidelines:

- Packed in strong containers that are adequately sealed and filled when possible.

- Make sure the weight is evenly distributed to provide proper bracing in the container, regardless of size.

- Put goods on pallets, and when possible, place them in containers.

- Make packages and packing filler out of moisture-resistant material.

- To avoid pilferage, avoid writing contents or brand names on packages.

- Use straps, seals and shrink-wrap to safeguard goods.

- Observe any product-specific hazardous materials packing requirements.

- Verify compliance with packaging documentation and markings for fumigation and chemical treatment.

- Special temperature or conditions (refrigerated, insulated, ventilated, open top, etc.)

- Fragile labeling (computer parts, glass, etc.)

- Special packaging (anti-theft for expensive items, adapted to the infrastructure of the importing country, etc.)

Step 2: Now my product is packed and labeled, who can help me ship it?

Labeling Your Shipment

A freight forwarder will help you ship your good to an international market. Some of those most commonly used in Montana are FedEx, UPS, and DHL- these companies have a fleet of vehicles that operate locally, can work to get your product out through US Customs, and into your desired region.

Freight Forwarders and Custom Brokers- what is the difference?Freight forwarders help prepare export documentation, book transport for your products, and, if needed, arrange for customs clearance at the port of arrival. You are not required to have a freight forwarder, but they can be useful, especially if you are exporting for the first time, exporting to a new country, or prefer someone else to handle these formalities. There are many large shipping and freight companies that fall under this category. Customs brokers focus on importing goods into a country. They act as an intermediary between the importer and a government’s customs department. Exporters don’t need a U.S. customs broker because they are shipping out of the country. Whoever is importing will need a customs broker. How do I know if I need to use a freight forwarder?

If you are shipping large volumes or very large items, a freight forwarder may make sense for you. If your shipments are smaller, you may be better off using a familiar parcel shipping company like UPS, FedEx, and DHL. These companies can take care of shipping and import clearance as they often have their own brokerage services.

Step 3: I have contracted with a carrier for my goods, what do I need to do for my goods to pass through US Customs and through my destination customs authority?

Mandatory Documentation for Every Shipment

- Airway Bill

- Bill of Lading

- Commercial Invoice

- Shipper’s Letter of Instruction

- Packing List

- Information Filed in the Automated Export System

Possible Other Documentation

- Certificate of Origin

- NAFTA Certification

- Certificate of Free Sale

Insurance

Insurance can be purchased through private banking or through a freight forwarded or shipper. However, the US government has a low cost alternative for many shipping and payment services through ExIm Bank (Export-Import Bank of the United States). Read about Montana businesses that have used their services and contact our regional representative for more information.

Step 4: My goods have arrived in country, what else do I need to know?

- Certifications

- Labeling of Your Product

What if I just want to temporarily export my goods then bring them back?

- ATA Carnet

This is like a passport for your goods. It is an international customs document that permits the tax-free and duty-free temporary export and import of nonperishable goods for up to one year. Examples of when you might use this are for commercial samples, professional equipment, and goods used for presentations at trade shows. In the US, ATA Carnet's are issued by the International Chamber of Commerce. There is a fee to get a carnet, based on the value of the good, a cost to bond your good when overseas, and some processing fees. Here is list outlining some of these fees. - Temporary Import in Bond

These are used in a very specific manner for certain products. Goods do not need to be returned to their country of origin, they just need to leave (or be destroyed) from the country they were brought to. These typically last one year and a bond, usually in the amount of double the normal duty, must be paid. This is a bit more complicated and nuanced option. An example of when you might use this is when you were exporting a number of goods to be tested, destroying some of those goods that did not meet qualifications, then exporting those goods that passed a test along to other countries. - Duty Drawback

Duty drawback is a refund of 99% of the duties paid on goods imported into the United States that are then exported, with the purpose of encourage and manufacturing and exports. Examples of when this might be used are when components pieces are imported then exported as part of finished product or when products are imported, then exported. Documentation is required showing duties paid, and manufacturing, and export.

More information

If you need further information on transportation, please reach out.