Native American Collateral Support

The Native American Collateral Support (NACS) Program addresses the lack of access to capital for Native American-owned businesses. This program was developed from the feedback of a diverse set of stakeholders that prioritized the development of a financial product and pathway for Native businesses to access financing and capitalize the launch and growth of their businesses.

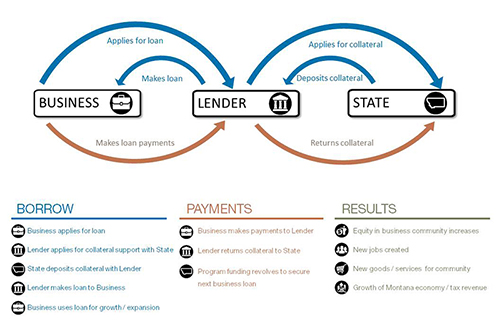

The Native American Collateral Support (NACS) Program addresses access to capital issues by providing collateral support security for Lenders making loans with Native American-owned businesses that only lack in sufficient collateral/equity for a business loan according to their loan risk profiles. (All other aspects of the credit analysis are satisfactory: cash flow, climate, character, and credit-worthiness).

NACS works with participating lenders to reinforce commercial and agricultural loans by providing a portion of the required collateral in the form of a Certificate of Deposit (CD) that can be held by the bank for five years. As the borrower's equity grows and loan payments are made, funds are released back to the Department of Commerce.

Click here for larger image.

Borrower Eligibility

- An eligible borrower is a Native American-owned business that is a recognized entity under Montana or tribal law that is registered with the Montana Secretary of State or under respective tribal ordinances.

- Borrower has a gap in collateral for a bank loan.

- The business needs to apply and be accepted for a business loan at a bank and talk to the lender about NACS. The Lender will contact OICED to discuss borrower eligibility.

- If eligible, the borrowers shall complete a Native American Business Owner Certification Form and submit it with their application.

- Ineligible borrowers are:

- Board members, Loan Committee members, officers, or employees of participating Lenders,

- Entities owned more than 20% or controlled by board members, loan committee members, officers, officers, or employees of participating lenders or immediate family (parents, siblings, children, spouses, or equivalent) of board members, loan committee members, officers, officers, or employees of participating lenders, and

- Borrowers who have had a past Department of Commerce loan balance written off.

Current Participating Lenders

How to Become a Participating Lender

- Eligible lenders are any bank, community development financial institution, tribal revolving loan institution, certified regional development corporation, micro-business development corporation, credit union, or local development corporation authorized to conduct business in the State of Montana.

- Request to execute a Lender Participation Agreement (LPA) with the Montana Department of Commerce.

-

Familiarize yourself with the Native American Collateral Support (NACS) Program process by reading the Lender Checklist.

There is no origination fee to Lenders to access these funds from the Montana Department of Commerce.

FORMS

Program Guidelines NACS OICED

Application Instructions

Collateral Support Application

Collateral Analysis Review Form

Native American Certification Form